NFT's - functional innovation or a bubble awaiting its burst?

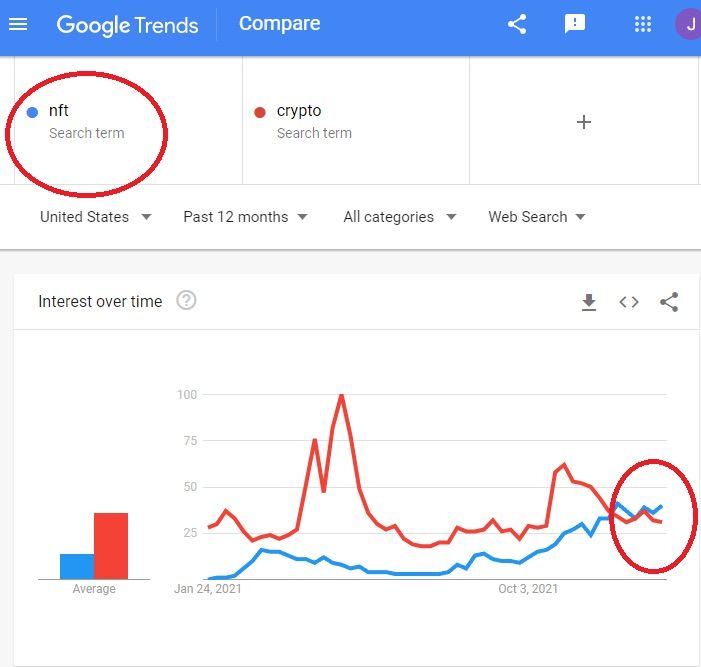

Just as widespread as the term cryptocurrency has become so has the abbreviation "NFT", taking over crypto in the google searches this week:

In this section, we'll discuss key points regarding the NFT space. All content on this page is purely for educational purposes and is in no way financial advice. Find below the table of contents.

click for: CONTENTS OF NFT's

- What are NFT's

- Why do NFT's have value?

- How to buy NFTs?

- How to sell NFTs?

- Now, how do you pick a project?

- Risks - greater fool theory

What are NFTs?

NFT is an acronym for Non Fungible Token. The words "non fungible" implies that the "token" is not replaceable by another identical item i.e. it is unique. As an example, dollar bills are fungible. You could swap a $100 dollar bill for another and it wouldn't matter as they would still be considered to have the same value, they are mutually interchangeable. Similarly, cryptocurrencies are fungible. Whereas, objects like diamonds and land are not interchangeable as each have unique qualities that give or take away value to/from them. In the case of the diamond, it would be attributes such as the cut, size, colour and grade - two diamonds of the same volume could have very different values in price. Your dog is also not fungible - I think that clears that up.

In the case of NFT's, these tokens/assets are created on the blockchain and include things such as artwork, virtual land, ownership of items and even tweets. But due to their nature, unlike crypto tokens, NFT's cannot be directly exchanged as they are all unique.

The blockchain keeps a digital track of all transactions on it publicly. Using this technology, a digital asset can be created and its data stored on the blockchain, acting as irrevocable proof, meaning its authenticity could be verified easily by anyone at a later date. The blockchain allows NFT's to exist because it allows immutable creation of unique items. In the past, any digital asset just consisted of sequences of 1's and 0's arranged in a specific string making them extremely easy to replicate by anyone in the world.

Prime examples of NFT's are projects such as Bored Ape Yatch Club, CryptoPunks & CryptoKitties. These have a huge community behind them which include many celebrities.

Why do NFT's have value?

"NFT's are worthless.... you can just right click save them!"

It's very easy to agree with this statment - it all seems like a hype bubble, but get this... art is fundamentally worthless. The Mona Lisa for example has no intrinsic value, but is by far one of, if not the most famous piece of artwork on the planet. As of 2020 the painting is valued at a staggering $860 million (I just searched this for the first time today; what the fudge?!).

The value in art is actually derived from human psychology, where the genuine, original artwork is deemed to be a rare, high-prized-by-society object. The artist's reputation, the gallery that holds the artpiece and the history of the work all contribute towards its pricing. The Mona Lisa was of course painted by the famous Leonardo Da Vinci and has a very colourful history which you should read up on if you aren't already familiar (I wasn't). The Mona Lisa is valued so highly not because of its artistic merit, but rather the hype and speculation that surrounds it (sounding familiar?).

But, the Mona Lisa can be replicated and defrauded. Infact, many famous museums and galleries unknowingly hold/sell faked artworks. Up to 20% of paintings held in museums may be fake but they still hold their allure and treasure due to their infered authenticity. Only to be swiftly devalued once an artpiece is discovered to be a fraud (This reminds me of the final scenes of the Netflix series "Money Heist", where the gold in the reserve is stolen and then ostensibly returned, settling the economic catastrophe, when in fact bronze ingots were returned in its place - if this little secret was exposed the disaster would return). Here's where NFT's really prove to be the future of art. The blockchain gives the original NFT value due to its proof of authenticity and any right click saved version of it would be rendered worthless due to this lack of verification.

And so, with the whole world transitioning into a digital era, NFT's are the next logical step and it is apparent why they have drawn so much attention. "2021 was a year of growth for NFTs, with sales hitting $2.5 billion in the first half of the year." Interest in the space spiked when celebrities and artists also began to jump on the craze, changing their Twitter and Instagram profile pictures to right clicked saved versions of their owned NFT's (humorous - but twitter is working to enable verified NFT profile pictures). This futher increased the hype, initiating price surges in the floor prices of those projects.

If you were able to say you owned the Mona Lisa, could you imagine the kind of marvel that would come with that? I believie in the near future, owning a Bored Ape Yatch Club NFT and possibly displaying it in your metaverse home would be of this prestige.

How to buy NFTs?

As of now, the majority of NFT's are minted (created) on the Ethereum blockchain, this is due to it being the second biggest blockchain and it's use of smart contracts over Bitcoin. Because of this, in order to purchase and hold your new NFT, you would need to set up/use a digital cryptocurrency wallet like MetaMask, Coinbase Wallet or WalletConnect and hold a little amount of Ether in said wallet to pay for gas fees (which could be up to $100).

Alright, there are two main ways in which you can buy an NFT: At marketplace or through an IDO - if you don't know what this means, link to our Crypto A-Z.

IDO:

Normally, especially nowadays the projects form a group chat via discord and you have to be in this to get your hands on the NFT's first as opposed to buying at the marketplace for an inflated price. Often, in these discord groups you would have to perform actions to level up such as inviting people and generally being an active member in the community. This would improve your chances of getting a hold of one of the NFT's once released.

MarketPlace:

If you weren't so lucky as to get one at IDO, the option still remains to go to the marketplace. Some projects sell their NFT's directly to the marketplace. There are a few options of where you can get these.

You can grab your NFT's at any of the main online NFT marketplaces, such as OpenSea, Rarible and SuperRave (there are many more).

OpenSea is said to be akin to the ebay of the NFT world. Here you can buy NFT's second hand and hold them in your digital wallet.

How to sell NFTs?

If you are a creator, you can create and sell your artwork as NFT's, potentially earning huge amounts in the process. In order to make an NFT of your work, you'll need to connect your digital crypto wallet to an NFT platform. You will need this to mint your NFT's on the platform, pay for gas fees & receive payment when your work has sodl (I'm trying to coin this term lool). This all sounds like a long and confusing process and it is a little tricky your first time around, but each marketplace provides a step by step guide on minting your art correctly on their platform.

Useful Resource: Here's a well laid out guide by the CreativeBloq on minting your NFT's.

If you are not a creator however and are looking to resell your bought NFT at the market place for a profit, you would have to navigate over to one of the aforementioned marketplace platforms and list your NFT. If the project you invested in has grown in popularity, you can expect the price of your held NFT to have inflated, leaving you a nice profit as a return. You could hold this NFT longer in hopes that the price may further appreciate but this also allows the risk of the price turning to the downside.

Now, how do you pick a project?

Picking a project to invest in is most important when trying to turn a profit. There are a couple key factors to consider when taking the plunge.

You should ensure to only invest in NFT's that you like, or are in a field that you have an interest in, for example soccer NFT's or NFT's of modern art. If you associate with a field, it is a great place to start your search.

You will need to do your own due dilligence (DD). Reasearch into the creator, the community and the project's goals/roadmap. The creator and the project's roadmap are important to look into for obvious reasons, but the community is paramount. As we've dicussed, the value of art has a bit of hype factored into it and thus the size and activity of the NFT project's community plays a huge part in the perceived value of these non fungible tokens. The community must however be healthy with a general positive vibe. Joining the discord group is usually a good way to gauge this - interact with the members, see how active & communicative the developers are. The twitter community is also a great place for this.

Usually, projects release up to 10,000 distinct NFT's in their collection and picking the right one is equally as important as picking the right project. Unlike crypto coins, you can't just exit, you'll have to find a buyer to sell your NFT to in order to exit. With this knowledge, if you are going for a quick flip, you'd be best off buying the floor i.e. the NFT's at the lowest price point in the project. This is because, most investors would sort the NFT's from low to high and a lot would not be able to afford the highest priced NFT's. This would significantly increase your chances of being able to offload the NFT as your NFT would be one of the most viewed - buying one of the most expensive NFT's is however an option and can be very profitable.

What you don't want to do is buy a middle teir priced piece as they are by far the hardest ones to sell, they get lost in the masses of other NFT's in the middle - how likely are you to scroll to page 57 on a google search? NFA though.

Risks - greater fool theory

Although NFT's expand to uses outside of just artwork, the majority as of now are just that. Most (90%) of these NFT's will probably go to zero. As of right now, most are based off of a lot of hype with some projects created just to take money from you with no real future plans. This is why doing your research is vital in this space.

Another problem that exists in the space is the need to someday sell your NFT to a buyer to realise profits. The greater fool's game.

With NFT's it is quite easy to fall into this. You purchase an overvalued, worthless art in hopes that someday a bigger fool will come along and buy the same art off of you at an even higher price. He/she then goes off on their journey to find an even bigger fool to trade their art with. Once a project/artwork can no longer sell for a higher price the floor price starts to tank and investors lose faith, starting a positive feedback loop or a cascade effect. The house of cards falls. Leaving the biggest fool with a sack of poo in their MetaMask wallet... hard not to laugh 😂.

Unless you are a collector however and have no wishes to sell your treasured NFT, hoping to one day hang it proudly in your Meta-home.

NFT word count: 66