When it comes to buying a home. The amortizartion schedule is a factor that not too many consider or are even aware of.

Equipped with this knowledge, we could all make better property investments. It goes without saying, this is not financial advice.

click for: CONTENTS OF AMORTIZATION SCHEDULE

- What is the Amortization Schedule?

- Amortization Schedule Example

- Strategy

- Useful Resource

- Calculator

What is the Amortization Schedule?

The amortization schedule as described by Investopedia is, a completed table of periodic loan payments, showing the amount of principle and the amount of interest that comprise each monthly repayment until the loan is paid off at the end of its term. Each monthly repayment is the same amount in total, thus the amounts of the principle and interest constituents vary dependent on the amount of outstanding loan left.

The amortization schedule is a useful tool in understanding how the mortgage loan works. It breaks down the scheme of payments of a mortgage over the agreed upon period and lays them out clearly in an easy to understand table.

The amounts of principle and interest in each (usually monthly) payment varies. This can be explained because the amount of interest that is paid each month is dependent on how much of the loan is remaining and the rest of the monthly payment then becomes the contribution towards the principle.

As an oversimplified example, if a loan amount of $100 is taken out to buy a home (probably a lego house but that's besides the point 😄), with monthly repayments of $1 and a yearly interest rate of 7.25% (about 0.6% per month) this would result in an interest charge of roughly $0.60 in the first month and the rest of the $1 would go to the principle - $0.40. You would now owe $99.60. The interest to be paid for the next month would be on this remaining loan amount (0.6% of $99.60) which would be $0.5976 and then $0.5952 then $0.5928 - you can see how over time, this interest amount would progressively decrease whilst the principle would continuously increase until the completion of the loan.

Notice that, early in the schedule, the majority of each repayment is interest because the initial outstanding loan balance, which is the basis for the interest calculation, is large; later in the schedule, the majority of each payment covers the loan's principal because the outstanding loan balance becomes smaller over time as the payments continue to be made. Meaning, in the first few years of the loan you would majorly be paying interest and barely chipping at your outstanding loan amount.

The amortization schedule is not exclusive to only mortgages and can be used in the context of many other types of loans, including car loans, student loans and personal loans.

It is a maths full idea and so may be a little confusing at first. Here's a real life example in case you haven't fully grasped the concept.

Amortization Schedule Example

An example of a realistic home mortgage loan:

Figures: $200,000 loan; 5%APR interest; 30 year loan.

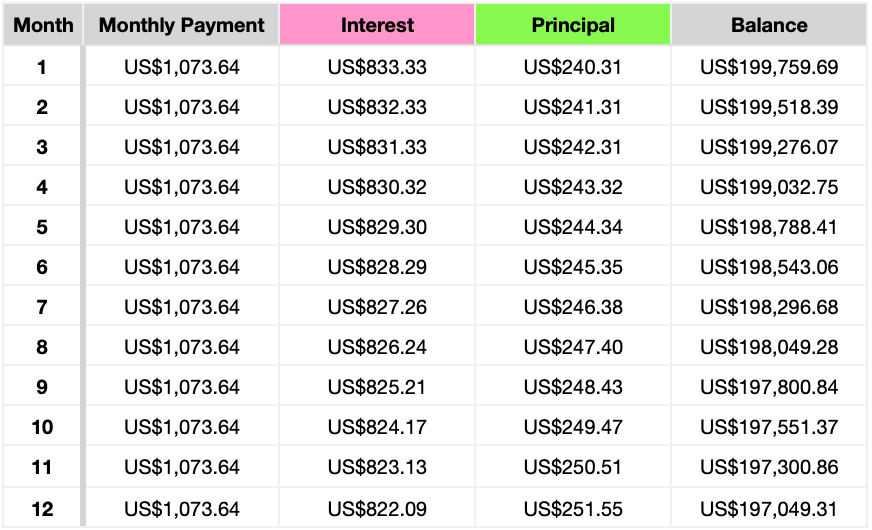

The first year of repayments would look like this:

The monthly payments were equal amounts of $1,073.64.

In this period:

Total payment: $12,883.68

Interest: $9,932.99

Principal: $2950.69

In this first year, 77.1% of all your repayment was in interest i.e. free money for the bank. Extrapolating the data, the figures for the completed 30 loan period are as follows:

$200,000 Loan;

$186,513.24 Paid in Interest;

$386,513.24 Total Payments Made

Over the duration of the loan, the interest equated to 93% of the initial loan amoun. The total payment is therefore almost double the value of the house. If the value of the house has not atleast doubled in this period, you have lost money!!! Pile on the effects of inflation and costs of living compounded over the 30 year period, the appreciation in the asset's value (well not really an asset as it doesn't cash flow) is even further insignificant.

Strategy

The amount of interest you pay on the loan is directly related to the length of the loan term, where the shorter the loan term the lower the total interest payment and vice versa. Opting for a shorter mortgage term is a viable strategy.

Let's compare the charts of paying the same $200,000 mortgage over different time periods - 10, 20 & 30 years.

10 years: Total Interest Payment = $54,557.28

20 years: Total Interest Payment = $116,778.95

30 years: Total Interest Payment = $186,513.24

the monthly repayments would ofcourse be higher for the shorter mortgages.

** need to add charts, not working rn for some reason?¿

Another strategy to minimize interest payment is through overpayments, which target reducing the outstanding loan amount consequently decreasing interest payments. Lenders only allow certain amounts of payments per year and these vary between lenders.

Bi-weekly payments are also another choice. This works on the premise that there are 12 monhts in the year and so you make 12 payments, there are 52 weeks in a year however so making bi-weekly payments results in 13 payments over the same period. You will essentially pay the loan off more quickly.

I felt it paramount to cover this topic here and try to spread knowledge as the ubiquitous notions of the American Dream and that buying a home to live in is a great investment are incorrect in many situations and can easily be a way to become a debt slave.

Useful Resource

A video I found that excellently descibes the amortization schedule with a great example. She also expands on the concept of paying the loan early with overpayments and biweekly payments.

Calculator

Formula for the nerds (like me):

M = P* r(1+r)n/(1+rn)-1

M - Monthly Repayment

P - Principal Loan Amount

r - Monthly Interest Rate

n - Number of Payments (In months)

Go build a calculator!!

There are numerous tutorials on youtube aiding in creating an amortization schedule calculator on excel.

Hope you didn't lose interest ;)