I feel conflicted about this topic, as I am fundamentally opposed to credit scores and credit cards but it is a huge part of financial literacy so here goes.

Well, I am not against them but I think they are over-glorified and often their pros do not even match their potential cons. If debt is not understood, it can have a catastrophic effect on your finances!

No financial advice should be taken from this article.

Lets kick this off🚀

click for: CONTENTS OF CREDIT

- What is Credit

- Credit Scores

- Types of Credit

- Credit Cards

- Good Debt vs Bad Debt

- Credit Landmines

What is Credit?

Credit is termed as a contract agreement between two parties, where one borrows from the other. The borrower receives an agreed upon sum of cash or an item of value with the expectation that the borrower will repay the lender the amount (almost always with interest on top) at a later date. These payments could be in regular installments or a bulk sum on the predetermined contract fulfilment date.

In a credit agreement, debt is created. Credit and Debt are often used intechangeably but there is a slight distinguishing difference. Once a credit agreement is opened, one party extends a line of credit to the other party. This party can be seen as the creditor. The receiving party is now in debt to the other party, they are now the debtor. The debtor is then expected to repay the creditor according to the stipulations of the agreement, often with a set interest rate, with the risk of persecution if dishonored.

Credit can also be defined as your history of borrowing. You can build up your creditworthiness by displaying good borrowing etiquette - utilising credit cards responsibly & completing loan terms without defaulting on payments both contribute to increasing one's creditworthiness. Creditworthiness can be represented as a number on a scale and is called a credit score.

Credit Scores

A credit score is a 3 digit number that portrays an individual's creditworthiness. The number is derived from an analysis of one's credit file and history. When signing up for a credit score, the applicant will fill out an extensive form of personal information to help link their credit profile to the account. This credit score value gives lenders an idea of your potential credit risk and likelihood to repay loans. Higher scores means less risk, allowing access to better loan agreements.

In the UK, the 3 main credit reference agencies (CRAs) are: Experian, Equifax and Clearscore. You don't have to choose, and can have a score on each of their sites, however these scores will differ as each provider's score is calibrated to different scales. In America, FICO and Vantage are the most popular CRAs.

On the Experian platform, scores range between 0-999 and there are different bands. The average experian credit score in the UK is 797 which is classed as "Fair".

The different credit score bands are: Excellent, Good, Fair, Poor and Very Poor. A score between 961-999 falls into the Excellent band. Good, ranges from 881-960. Fair: 721-880. Credit scores below these are then called poor and very poor.

On the Equifax network, the scores range from 0-700. An excellent credit score falls between 466-700. A score of 420-465 is termed good and a fair score is between 380-419. Clearscore scores are based off of Equifax information.

Improving your credit score can be achieved through use of various credit instruments. This process takes time, patience and extreme care.

- Build up your credit history - shows proof of good debt managment. Take out a phone/sim contract or pay your car insurance monthly. Using a credit card to pay for your day to day expenses and repaying the amount in full by the end of the month is also a good way of building a history of credit.

- Pay your bills on time and fully every month - shows good credit responsibility.

- Avoid making too many credit/loan applications in a short period of time - each credit check will take a knock at you credit score.

- Maintain a low credit utilisation - this shows you don't exessively take on loans.

- Join the electoral roll at your living address - this aids in confirming your identity.

Having and maintaining a good credit score puts you in an advantageous position, as you are more likely to be accepted for credit applications. Excellent credit scores expose you to larger loan sums with the added benefit of lower interest rates - the cost of taking out the loan is reduced. Your credit score is your digital financial footprint. Tread carefully as its effects are long lasting.

Types of Credit

Common examples of credit accounts are: credit cards, mortgages, car finance and student loans. They are not all treated equally and fall under 3 main categories. Having a good mixture of each kind can help in boosting your credit score.

Revolving, instalment and open credit. These 3 types of credit differ in the way they are borrowed and repaid.

Revolving credit allows for repeated borrowing up to a preset limit. But this amount needs to be paid by a due date (monthly for example) or interest and fees will be charged. Credit cards are set up with this structure. Home Equity Line of Credits (HELOCs) are another less known example of this where a line of credit is extended against your home, your home posing as collateral. They often offer higher credit limits and better rates, as they are backed by an asset, but you run the risk of losing your home through forclosure.

Instalment credit is a loan where a lump sum is borowed and repaid with interest in regular installments for a fixed period. The account is closed once this period is completed. Examples include car finances, mortgages and student loans.

Open credit include bills such as electricity, water and phone bills. Their balances are due on a billing cycle and the amount is dependent on how much you consume in that period.

Credit Cards

Credit cards are an instrument, that if used correctly can be a beneficial financial tool. There are a myriad of credit cards available out there. You will be given a pre-set limit on the card and sent a spending bill each month. With the correct approach, you can spread out the cost of things you'd like to buy now without payment of any interest rates whilst boosting your credit score. Some credit cards allow for rewards on your everyday spending.

Most banks offer credit card options but a credit check will be performed before these products are issued. You do not need to pay off the full amount every month but there is a minimum amount that will need to be paid or a default will be recorded on your credit file. This minimum amount is usually 1% of the outstanding balance and an interest will be charged on the amount owed. Some credit cards also allow for cash withdrawals from an ATM but there are hefty fees for this sort of transaction. Here, good financial discipline is required as a huge bill can be formed after consecutive months of not paying the full amount.

Credit card perks include cashback offers or points that can be turned into vouchers for shops, hotels and even airlines. For example, you could get 3points/dollar spent at eligible restaurants and flights booked. The more you use and spend on these credit cards, the more rewards can be harvested.

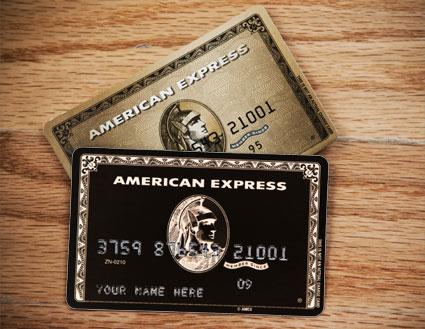

American Express credit cards are some of the best paying reward cards on the market. You may have seen/heard the hype around owning an Amex card or the mystical Amex Centurion Black Card that doesn't decline, though there are set requirements for obtaining one of these.

Amex offers a wide range of credit card products. Each with different characteristics to suit the various types of card holders, ranging from the serial traveller to the everyday spender & cash reward chaser. Each card differs in annual fees, monthly limits and potential rewards. There are also preset minimum spends required to earn these rewards. Having an understanding of each card's value will aid in choosing the most suitable. Here's an article that outlines the requirements and benefits of each of the cards in the Amex range.

Good Debt vs Bad Debt

Not all debt is the same. Across the different types of debt, it can be said that some debt is better than others. While debt is often taken on carelessly, some kinds of debt can be justifiable.

Good debt is defined as one that has the potential to increase your net worth or enhance your life in an important way. Bad debt is attributed by borrowing sums and acquiring depreciating assets or consumable items. Differentiating between good and bad debt can be subjective and depends largely on the individuals financial position.

Examples of good debt are real estate, business loans and self education. Debt can be leveraged to turn a profit/income in each of these areas and thus here, debt is seen to be justifiable.

Bad debt include: cars, clothes/fashion and consumables which are all depreciating assets and have no capacity to generate any cash flow. Borrowing to have access to these items are bad from a financial perspective. Find cheaper alternatives if they are requirements for your situation.

Credit Landmines

Like I said at the start of this post, I have my reservations with credit scores and credit services as often their cons are far more grave than their pros. I have a slight bias though as I am against the bank system as a whole; I view them as a business not a friend and all businesses are profit driven.

Banks tend to feed off those with poor money management skills as this is where they make their money. Interest and borrowing fees is their business model and they incentivise borrowing with perks on credit cards and coercing individuals to borrow to boost their credit scores. Credit scores which are only one of many factors considered when taking out larger loans like mortgages or business loans. Having a good credit score is beneficial but there are far more important things to concentrate on than having a stellar credit report.

Banks need to boost borrowing as this is how new money is created and pumped into the financial ecosystem. This keeps the wheels of the economy spinning but leads to inflation in the grand scheme of things.

Credit is just one part of your financial arsenal. Efforts also need to be made in Saving and Investing.

Aaaanndd... roll credits