In recent years, the term “Crypto” has become ubiquitous. It’s as though, no matter what kind of rock you live under, this word will find its way to you. No escaping.

So, what is crypto?

The word crypto is commonly used to refer to cryptocurrencies and cryptotokens. However, the word crypto actual refers to cryptography and the technologies based off of it, under which, these cryptocurrencies fall.

Cryptography is a complex yet interesting topic which takes a while to wrap your head around. There are numbers, letters … combinations of letters and number, complicated maths and concepts that will leave you either baffuzed or falling asleep.

If you’re anything like me, you just want to know the basics. Know enough to get on with risking all the savings you acquired from the Finance Segment and dumping them in meme coins like the degenerate trader you are…

... just kidding. As sketchy as some of it may sound, there actually is a method to the madness and ways to see astronomical gains from your investments (to the moon baby 😎). Nothing in this post is financial advice of course.

The key principles here are timing and controlled emotions. But first, let's talk crypto basics.

click for: CONTENTS OF CRYPTO 101

- Cryptography overview

- What is Blockchain?

- Benefits of Blockchain

- Blockchain Downfalls

- BTC & ETH

- Alt Coins

- Meme Coins

- Trading Strategy

Cryptography Overview

Cryptography is the study of transfering information in a secure format such that only the sender and the intended receipient can veiw the contents. Data is encrptyed using a secret key, making it difficult to decipher. Only the intended recepient has the correct key to decrypt the data, meaning, if a third party were to intercept the data, they would have no luck cracking it.

If you'd like to dive a little deeper, TechTarget gives a comprehensive article on the subject.

Cryptography is of great use when sending critical or sensitive information - making it ideal for blockchain technology.

What is Blockchain?

To put it simply, a blockchain is a system of several computers, also called nodes that all individually keep a record of all transactons in that system. Each transaction is called a block and this chronological chain of blocks is called a blockchain - mind that this is an over simplified explanation but covers the general idea. In reality each block has a capcity and transactions are grouped into each block till it's filled and then the new block begins to hold the new transactions.

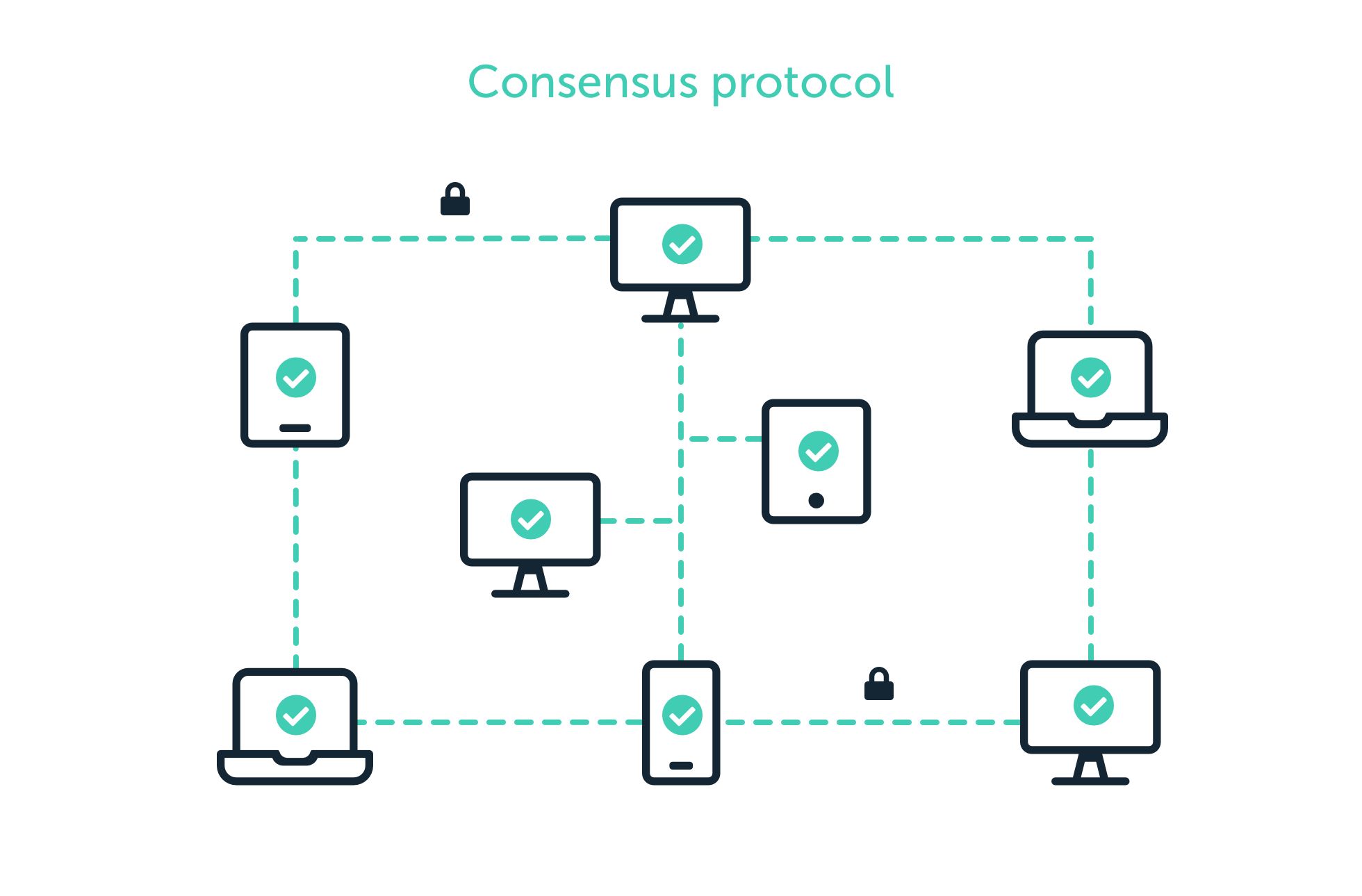

In order for a transaction to be approved in the system, the validity of the transaction must be confirmed by the nodes. This is achieved in different ways, depending on the blockchain system. Bitcoin & Ethereum for example use a proof of work (POW) verification mechanism. Here, complex math equations are solved and the node that solves the equation first is rewarded in the native token (providing an incentive to create more nodes to keep the system turning). This new block is sent to all nodes on the blockchain to verify and once concensus is reached that the block is valid, it is added to the blockchain on all nodes.

Benefits of Blockchain

Secure - Blockchain uses cryptography. This keeps the information involved highly secured aswell as efficient and private.

Transparent - This code is open source meaning it is transparent and accessible to anyone to scrutinize yet immutable - it cannot be changed unless the agreed upon by the majority.

Decentralised - The blockchain creates trust by removing the need to trust humans. The "code is law" and sets all the rules for the governing of the system as opposed to organisations controlled by human CEO's etc.

Potential - the uses of the blockcahin technology stretches out further than just cryptocurrencies. Systems can be created for applications in Healthcare, Education, Insurance and Voting to name a few.

Blockchain Downfalls

Environmental Effects - the "mining" of crytocurrencies such as Bitcoin & Ethereum are very expensive and energy draining operations. The effects of these high energy consumptions on the environment are devastating.

Low transaction speeds - due to the "POW" system which Bitcoin & Ethereum operate on, the networks are relatively slow - 7 & 15 transactions per second respectively. This is appaling when compared to the 65,000 transactions per second of Visa. Ethereum however is moving to the "POS" system to give a qouted 100,000 transactions per second. There are also many other alternative platforms which are a lot quicker than these... my favourite being Cardano.

Regulations - currently alot of the crypto sphere is not regulated by a body and thus there is a lot of talk about the effects of the governments trying to impose control over the space. Laws may also vary depending on regions.

Storage - the sheer size of the different chains and the rate at which they are growing may cause problems when it comes to storing all of the required information.

BTC & ETH

Bitcoin and Ethereum are the two largest, most known crypto currencies in the digital universe, being the 1st & 2nd cryptocurrencies ever created respctfully. They however are very different in many ways.

Bitcoin was created for payments & scarcity and is commonly refered to as "digital gold". Ethereum on the other hand uses code to create a platform upon which many services can be created - lending, trading, gaming and art. Both systems are decentralised and are powered by the proof of work principle to secure transactions.

Bitcoin was created in 2008 by Satoshi Nakamoto back when the centralised financial entities failed. Ethereum was launched in 2015, inspired by Bitcoin but improving upon it with the addition of smart contracts. This gave Ethereum flexibility and future potential over Bitcoin.

Trying to understand all the fundamental differences between Bitcoin & Ethereum will lead you down a very very deep, rabbit hole. This is a topic for another day/blogpost. The key takeaway here however is:

Bitcoin is a cryptocurrency; Ethereum is a platform & Ether is the native token on the Ethereum network.

Alt Coins

Alt coin (Alternative Coin) is a term used very commonly in the crypto community. An alt coin is any cryptocurreny altertanative to Bitcoin - yes Ethereum is an alt coin but generally when the term is used, it is in reference to smaller projects.

There are thousands of alt coins as of today with the most common being: Ethereum, Cardano, Polygon, Solana, Terra, Avalanche. They are all different in their own ways and have very different use cases. There are also other coins with no specified uses called meme coins.

Meme Coins

Meme coins are described as a cryptocurrency that originates from an internet meme or has some other humourous characteristic. Popular meme coins include: Dogecoin (created by Elon Musk), Shiba Inu (and many other coins with the word "Inu" - it means dog in Japanese), Dogelon Mars etc.

Most of these coins have no essential use and are powered by speculation, with large fluctuations in price whenever Elon Musk or any major influencers tweets about them otherwise known as "shilling". Other coins are created to make fun of the whole idea of cryptocurrencies and these have a comminity backing them. Others are big scams called "Rug pulls" - as you can see there are a load of new terms to become accustomed to when trying to navigate the crypto space, link to our article on Common Crypto Terminology to get a head start.

Although they seem to be a big old joke, they are actually a great oppurtunity to 10x your investment if treated carefully - Yes, carefully you degen cowboy.

Trading Strategy

When it comes to investing in crypto, strategy is everything. There are projects which can be seen as quick flips where you'd need to be in and out very quickly. Other projects are long term holds where you believe in the growth of the project and are willing to invest over time to see your returns. This is termed "Hodling". If you are of a trading background, you could treat the currencies as any other tradable asset. Making gains from the fluctuations in price.

There are also communities on applications such as Telegram and Discord. These could help give information on Fundamentals and other important things that may give an indication of what prices of differing coins may do.

Traversing the Wild West that is Crypto.