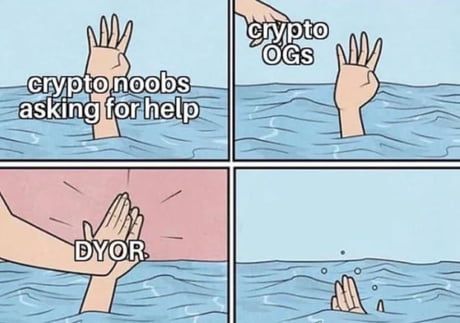

DYOR: Do Your Own Research

A common term in the crypto sphere which is good advice yet no financial advice (which I also do not provide).

Similar to stock investing, any sensible investor would look into projects before deploying capital, after all, crypto projects are companies/businesses in essence. Unlike typical research however, the places you may find pertinent information differ. In this case, mediums such as Twitter, Reddit and Discord are akin to research papers, Google Scholar and traditional books.

Importance of doing your own research

Money is at stake. The main goal is to make money not lose money.

With a multitude of shams out there waiting to trip you up and shake you out of your money, it is paramount to be meticoulous in your operations. Preparing and having different strategies and knowing when to employ each one will have you better suited to actually turn a profit from your investment efforts. For instance when dealing with a market that is pumping or dumping, when trading micro cap or blue chip coins and when degenerately going long on a meme coin. Research and preparations will go a long way.

Mind, it does take time and there is a lot of information out there that may mislead you, which is why it is so important to learn how to effectively and correctly carry out your own crypto research.

Means of doing your own research

When starting off looking into a new cryptocurrency project, YouTube is a great place to start. Depending on how new the project is, there should be a vast range of YouTubers/channels covering the project in depth. Mind that not all analyses are reputable and some maybe be shilling certain projects to inflate their own personal bags. Try to find YouTubers/Channels that are impartial, examples include: "White Board Crypto", "Coin Bureau" & "Paul Barron Network". Often these channels will go through the project's website and white paper, summarising it for you which saves you the hassle of doing it your self. Protip: Make a new YouTube account to follow all your favourite crypto channels and influencers - it'll be easier to see all new posts, helping you stay up to date.

For a deeper dive into the project, you could visit the project's website to get a feel for what they are and what they intend on accomplishing. Reading the whitepaper is a good way of achieving this. Key points to look out for here are: The history of the cryptocurrency, details of tokenomics, the founders & key individuals, roadmaps aswell as the intended use case of the token - you may want to grab a notepad. Protip: Look up the founders and developers of the projects and try to find YouTube interviews of them describing their project.

Messari, Binance Research & ICO drops are all handy and powerful tools to have in your arsenal. These sites are credible and professional, striving to get all the facts 100% right. You can check and read through their coverage of numerous crypto projects to aid in your decision making process. Dyor.net claims to "analyse the cryptocurrency market for you", providing information on the trends, technical analysis indicators and sending you alerts. But unlike the aforementioned sites, it requires a subscription.

Twitter is a great way to keep up to date with project updates as well as veiwing what other investors are feeling and speaking of. Simply entering the "$" sign followed by the token's abbreviation (with no spaces) into the twitter search bar will return all tweets about the specified project. This will highlight any red flags to steer clear of and/or show you the general hype behind the project. Often the project would also have its own twitter account, following this would help keep you in the loop. Following the personal accounts of the founders and developers is also not a bad idea as it would give you an insight into their thoughts aswell as what they have planned for the future.

Discord groups for projects. This is a place where all the investors of a project gather and provide alpha, often you will find gems here and can also directly find answers to queries by the founders.

Stay up to date and be cautious, losing out to a rug pull and seeing the characteristic rekt chart on CoinMarketCap is no fun!! Getting fully immersed in the project on all fronts gives you a true feel of its fabric/make up and allows you to make better informed investment decisions.

Crypto could be my second PhD