Why have interest rates gone up? What is inflation and how does it affect us?

Following the recent news of the US Federal Reserve's Chair, Jerome Powell, increasing interest rates in March 2022, I felt this would be a pertinent topic for my next post. Strictly no financial advice is given in this post.

click for: Inflation & Interest Rates

- Inflation

- Interest Rates

- Link

- Other Measures

- Banking System

Inflation

Inflation is the rate at which the price of goods increases over a given period of time. It is also termed as the increase in the overall cost of living in a country. You hear of the word often from banks, governments (and politicians with their false promises).

In the Uk, the target rate of inflation is 2%. The REAL inflation rate is far above this however. It lies at roughly 7% and is probably even as high as 10% resulting from the increases in energy costs as well as the cost of imported goods.

Inflation is measured using a basket of commonly purchased items (decided through household surveys) whose cost is tracked over time. The relative change in the price of this basket is known as the consumer price index (CPI) and the percentage change in the CPI over a specified period is seen as the inflation during that time. As an example, if the CPI grew from 100 to 110 over two years, the inflation rate is 10% for this period.

The price of housing was once factored into the basket of goods but as the price of homes began to rocket, the basket of goods became more and more expensive, raising inflation tremendously and thus the government removed it to keep the value of real inflation low. The government continously manipulate the CPI(CPLie) in this way to keep infaltion at and around their targets to mask how rapidly the British Pound is being devalued.

The government aims for an inflation rate of 2% as it is a sign of a healthy and growing economy. A negative inflation rate would mean that the price of a good will be cheaper in the future and thus consumers would opt to hold onto their money to make purchases at a later date, grinding the economy to a halt. A slight stable inflation rate is therefore beneficial for an ecosystem; in theory anyways.

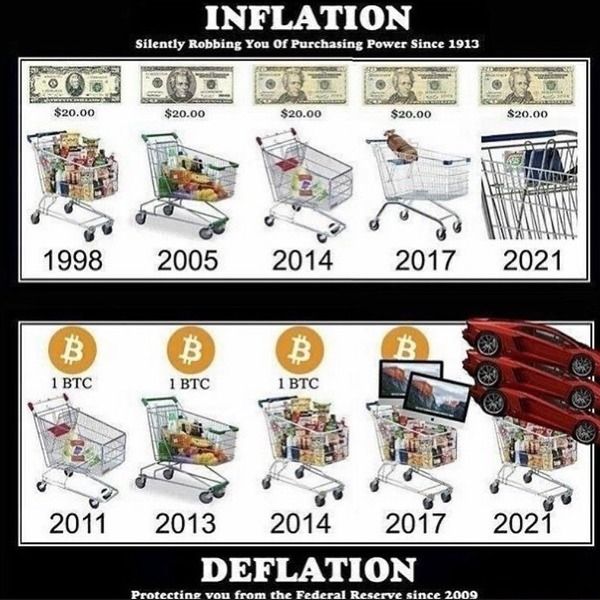

Due to the real value of inflation, money sitting in a savings account is diminishing. By saving you are techinically getting poorer by the day. Here's my shill of crypto. Invesments are the best hedge against inflation and this is why it is so important to become educated in this area. Navigate to the Investments segment of this site for a range of investment articles.

When investing in an asset, it is important to target a return of above 10% in order to surpass the effects of inflation. The potential realised returns in crypto dwarf this...

Crypto is the fastest growing asset class at the moment (or ever). Most of the top 20 coins are non-inflationary as they have a set limit of the number of coins to be ever created. In some cases they are actually deflationary and their value will increase over time. I am extremely bullish on crypto.

Interest Rates

Interest rates are set and changed dependant on the state of the economy at the time. They are increased and decreased quite regularly (8 times a year). Factors such as the prices of energy, wages, imports and the consumer spending all play a role in their fluctuations.

"Interest rates" is a blanket term for a wide range of interest rates related to the economy. The FED/BoE influence interest rates by changing certain interest rates that affect private banks. This consequently treacles down the system, altering interest rates that affect the consumers. The most impotant interest rate to the FED is the Federal Funds Rate (FFR) and they keep it within tight reigns. Currently it is kept between a 0-0.25% range. Private banks borrowing to/from other private banks to settle their overnight balances set their rates within the target FFR range and so we can see how the FFR directly affects banks.

The FED alters the upper and lower limits of the FFR range using two other interest rates: the interest on reserve balances (IORB) and the overnight reserve repurchase agreements (ON RRP) - it's getting complex, I know.

The upper bound of the FFR is set by the tweaking the IORB. This is achieved because banks looking to lend to other banks in the overnight lending market would need to have an interest charge that is competitive, else the borrowing banks would opt to go to the FED's discount window to settle their balances.

The lower limit of the FFR is controlled using the ON RRP rate which essentially sells the bank a security overnight and buys it back in the morning for a higher price. This buyback price is set by an interest rate and this creates the lower limit of the FFR.

The FFR is put in place and controlled closely by the FED to prevent the interest rates between private banks skyrocketing. When the FFR range rises (the cost of borrowing increases for banks), banks must charge their customers more for loans to remain profitable.

Link

There is a clear link between inflation and interest rates. When interest rates go up, inflation goes down and vice versa. They are inversely linked. This link is established due to the change in consumer and business behaviour associated with higher or lower interest rates.

When interest rates are increased, borrowing by consumers and businesses is reduced, as the cost of borrowing is too high. Consumers will look to deposit more money in the bank in order to milk the better returns of a savings account. The activity of the economy falls and thus supply outweighs demand. Prices drop, meaning a less inflated marketplace.

In the polar example, interest rates can be decreased when inflation and market activity is low. This spurs more borrowing by consumers and businesses as the cost of borrowing is reasonable. These parties will now have more spending power which drives up the economy. The supply and demand ratio changes, and prices will start to inflate.

It is like a See-Saw/balancing act controlled by the FED or BoE to keep inflation within a certain range (2-3%). It doesn't always run so smoothly.

Other Measures

This link is theoretical and although it has been shown to work, in the real world, there are many other factors that come into play that can really sway market conditions. Changes in interest rates only affect short term inflation.

With all these other parameters factored in, interest rates can be reduced all the way down to zero or near zero in an attempt to boost the economy with no success. This is when governments and the central banks deploy more advanced techniques to get the economy pumping again.

These techniques include Bond BuyBacks, Open Market Operations and Quantatative Easing. Delving into these would take us down a huge rabbit hole and that would be out of the context of this post, here's a useful resource for your inquisitive minds.

Quantitative Easing is often viewed as money printing but this is not actually the case, they are simply offering more liquidity to the market. Borrowing from banks is what creates new money.

Banking System

The real money printers. When a private bank extends a loan, new money is created. Banks are no longer limited to how much money they can borrow. They can continually grant loans as long as they believe it will be a profitable exchange. Hence, banks incentivise borrowing at all costs.

The banking system has huge cracks in it and continously printing new money is just their way of plastering wallpaper over it. These corporations are essentially kicking the can down the road and eventually this will catch up to them. The house of cards will fall. Impending bankrun.

Inflation isn't all that bad, we still need baloons :)