Are you dollar-cost-averaging into govt bonds or degenerately splurging on microcap alt coins? (Make it rain baby...).

The two choices seem to be either, replicating Warren Buffet's compounding strategy or becoming a 12-year-old crypto-millionaire.

Most likely you've heard the saying "High risk, High reward", but you've likely never heard "Low risk, Low reward", as this in not necessarily true... keep reading, we'll explore this.

I'd say that, naturally or intrinsically, different people have varying proclivities to risk. Some are high risk takers and some are much more risk averse and these attributes are translated to and can be seen across a wide range of fields, ranging from business, to gambling and even to sports.

The heading image of this post depicts an individual embracing the edge of the cliff and their two companions running away from it. A clear disparity in tolerances to risk.

An example of risk I always like to think of is as exhibited in baseball players. There are those who swing for a home run every time they step to the plate and those whose strategy is to play is safe and get the 4 points the slow way. Shooting for the fences seems like the logical option, but as we all know, this often comes with the chance of being struck out. No Bueno.

Determine Your Risk Appetite

Figuring out your personal risk appetite can play a crucial role in managing risk in your decision-making process. Again, risk tolerance varies greatly between individuals.

Even the word "risk" elicits a different feeling/thought between individuals. When you hear the word, do you immediately think of the potential for upside or does it send a shiver down your spine, as you fear you will be left with nothing?

Same word, different response. Risk is evidently a mindset/mentality thing & your tolerance for it will likely have a positive correlation with your previous experiences with it.

Rate your risk appetite:

- Very Aggressive: Very high appetite for risk, preferentially chooses options with higher/highest gains.

- Aggressive: Comfortable with high exposure to risk, chooses options that have a high enough likelihood of success with good rewards.

- Moderate: Willing to tolerate small amounts of risk for a gain, chooses low to medium risk options with acceptable rewards.

- Conservative: Disinclined or reluctant to take risks, chooses low risk options as standard.

- Very Conservative: Risk averse, guarantees are paramount.

Before reading on, What level of risk appetite do YOU think is most advantageous?

Juxtaposition

So what is it then? "Go big or go home" or the "Turtle always wins the race"?

It goes back to the old adage, "slow and steady wins the race." In investing terms this means, playing it safe and always making the safe bet. Although the hares seem to be faster (and win big), they can also lose it all just as quickly.

Don't pay the hares any mind. Be the turtle! (it's a little more nuanced than that though).

If you start compounding with $1, the turtle will die before this fund grows into anything substantial. That is to say, you need to first acquire capital before you can reap the benefits of compounding - a 5% return on a thousand and on a million are galaxies apart.

What is Compounding?

Whether it be in investing, business, or life itself, there are many many years to this "game". As Simon Sinek says in his book, these are infinite games/races, where there are no winners or losers, only those who are ahead and those who are behind. Those ahead are the ones willing to play (and keep on playing) the long game, for the longest.

Compounding is said to be "the eight wonder of the world... those who understand it, earn it and those who do not, pay it". A quote from Albert Einstein.

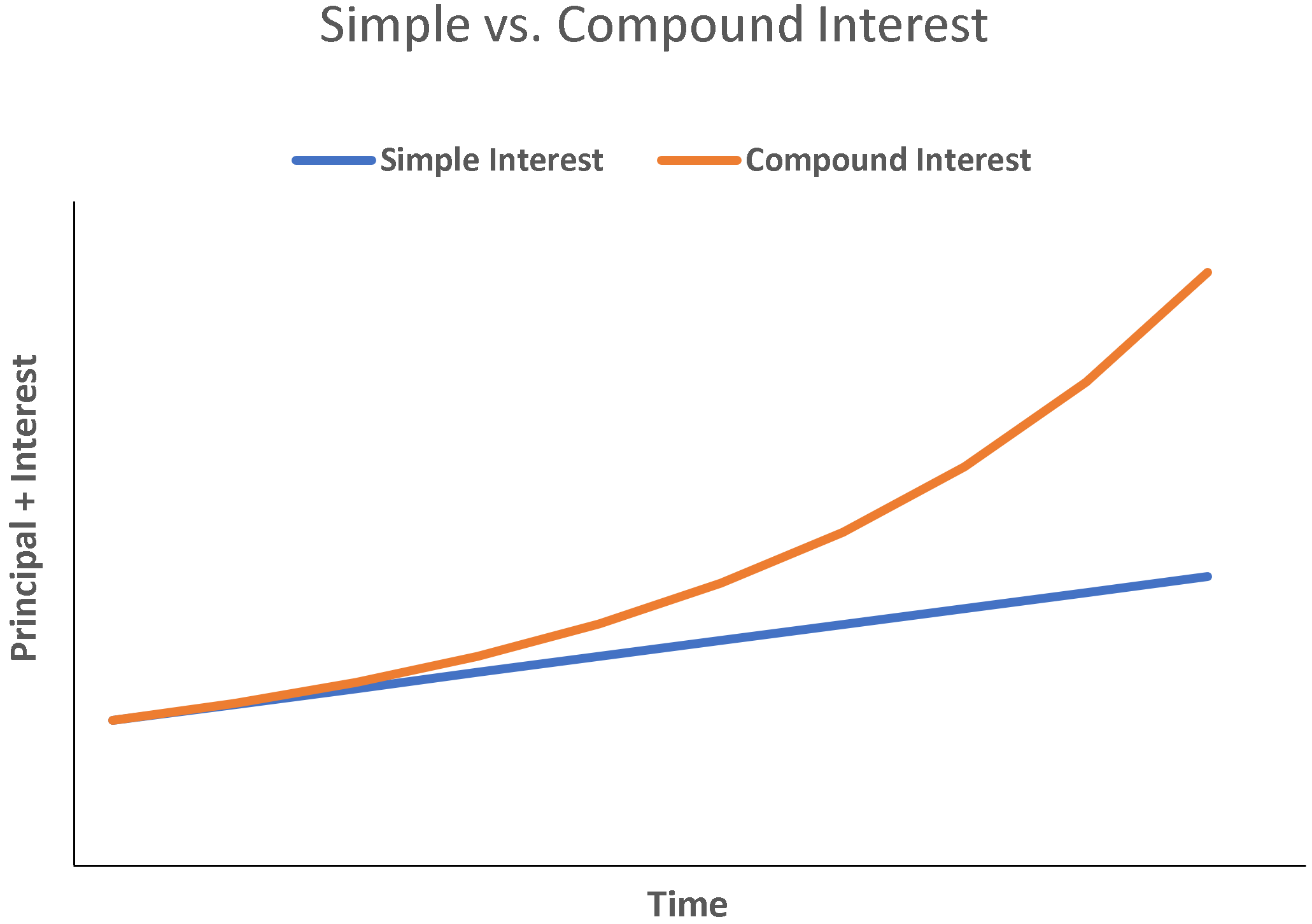

If you're from a maths background, you'll already know about the exponent function. Compounding is an exponential function which means it gains and grows more and more sharply as time progresses. The illustration below depicts the nature of exponential growth as compared to linear/simple growth. As time progresses, the difference becomes more and more apparent. It's a long game thing.

*Note, the interest rate largely affects how steep and fast the amount grows. In other words, a low-risk investment option would not compound as quickly as a higher risk option would.

Risk Capacity

Here's where a term called "Risk Capacity" comes into it. Your risk tolerance is something that generally does not change, as aforementioned, some people naturally are more risk averse than others. One's risk capacity however can and does change.

Your risk capacity usually, is linked to the stage you are at in your journey, and transitions accordingly. One with a mortgage, business and kids approaching college age would far less likely take on life changing risk than a single individual with minimal financial commitments.

There's a balance (as with everything) - initially you'll take on more risks as you have less to lose but once you've reached a certain point, strategies and decisions have to be more meticulously employed. (Keep reading for yet another alternative - it's never black n white is it? 😄).

so...

hare ---> turtle

Initially you run because you haven’t anything to lose and what you do have can’t create any motion in the sea of life. Once you’ve accumulated a respectable sum of money however, you switch gears and enjoy the sweet fruits of compounding.

Acquire Capital -> Grow Capital -> Keep Capital

*Note, acquiring your initial capital is the hardest stage. Read "How to Make Your First £/$100K"

Bible Example

In the Bible, there is a parable told by Jesus to his disciples in Matthew 25:14-30.

It tells of a man who was travelling to a faraway land. He divides and entrusts his wealth to 3 of his servants according to their abilities. To one he gives 5 talents of gold, to the second he gives 2 and the third a single talent.

After a long while, the man returned from his journey and checks in with his servants. The first servant doubles his 5 talents, to 10 talents. The second also doubles his 2 talents to 4 talents, but the last servant buried his bag of gold for the whole period due to the fear of losing it all and only returned to his master, the original talent of gold. The man scolded this servant and gave his bag to the servant with the 10 talents of gold.

From this short story, three key underlying truths stand out to me.

- Investment is key. The parable recognises risk and promotes it. Those who avoid it out of fear exhibit poor money management and will be punished for it in the long run.

- Starting Capital. Although the first and second servants did the same amount of work and yielded the same ROI, the first servant saw a greater unitary gain. This goes to show that more money begets more money.

- Diversification. Not directly linked to the concept of risk tolerance but still in the field of risk, the man diversified his investments. Although he knew the first servant was the most competent, he wisely spread his risk proportional to the abilities of his servants.

*Bonus*: The rich will always get richer. For no extra work, the first servant received an extra talent of gold.

Risk as it Applies to Real Life

Decision making and opportunities. Take that risk, ask that girl to dinner or the prom. Take on the new job, move to another city, post that first YouTube video. The take-away from this should be that good management of risk yields success whilst avoidance breeds failure.

Consider your innate tolerance to risk, evaluate your capacity for onboarding risk and make an action plan. Educated risk taking. You will be burned many times, but this is an integral part of the process. Create your own luck, the more risks you take the luckier you get.

Two areas you do not want to be termed as high risk are in the fields of insurance and credit as it bumps up your premiums. Here you would be optimising for mitigating risk.

No Risk No Fun(ds)