As important as it is, with it's huge impact on our finances, tax is a widely neglected/misunderstood aspect of personal finance. It's effects can greatly impact your ability to generate wealth. It is not taught in schools, so yet another you've got to self-learn. The schooling system ayy.

Taxes are applied to all incomes differently and knowing how they affect you will have you better situated to handle (or circumvent) them.

As they are heavily dependant on the mix of, amount and type of your income(s), taxes are very situational... but knowledge of the general basics will give you a booster. No financial advice to be found here, get yourself an accountant.

click for: CONTENTS OF TAX

- What is Tax?

- Income Tax

- Corporation Tax

- National Insurance

- Inheritance Tax

- Closing Thoughts

What is Tax?

In the UK (and in most other states), taxes are a major source of revenue for the government. They are intended to be used to maintain and improve public services as well as to help the government in the smooth running of the country. These include things like building roads, schooling, emergency services and welfare schemes. Tax money also goes towards: transport, debt, military, health and various other smaller sectors.

In the UK, the goverment authority in charge of all things tax is Her Majesty Revenue and Customs (HMRC) - colloquially called the "Tax man". This body aims to:

"help the honest majority to get their tax right and make it hard for the dishonest minority to cheat the system".

There are a myriad of taxes out there. These include: VAT, National Insurance, Income Tax, Corporation Tax, Inheritance Tax and so on. They are all regulated individually.

Income Tax

Income taxes are taxes that are applied to the earnings of individuals. This applies to employees, self employed individuals and investors. These taxes are progressive, meaning that the tax rate is increased as the tax payers income increases. This is opposed to proportional tax where a flat tax rate is set regardless of .

The three main types are: Earned/Employment, Passive & Portfolio. Here they are each broken down.

Earned/Employment Income:

These taxes are taken directly from an employee's salary and is reflected on their payslips as PAYE - or Pay As You Earn. The money is sent directly to HMRC, occurring automatically dependent on tax code. Tax codes are also displayed on the employee's payslip. It is important to check and ensure that you have been assigned the right tax code as this would affect the amount in taxes you pay.

If you are assigned the wrong tax code you may pay too much tax, in which case you will be issued a refund from HMRC but if you've underpayed, you'll be served a bill.

The alternative to PAYE is self assement which is exclusively for those that are self employed. They are required to fill out a self assessment form each tax period.

Tax codes are used by your employer to calculate how much tax is required to be substracted from your income/pay. Tax codes are provided by HMRC and each have a seperate meaning. The letters in your tax code refer to your situation & how your personal allowance is affected. For instance, the tax code:

1257L means you're entitled to the standard tax free allowance.

The meanings of all other tax codes can be found at Gov.uk.

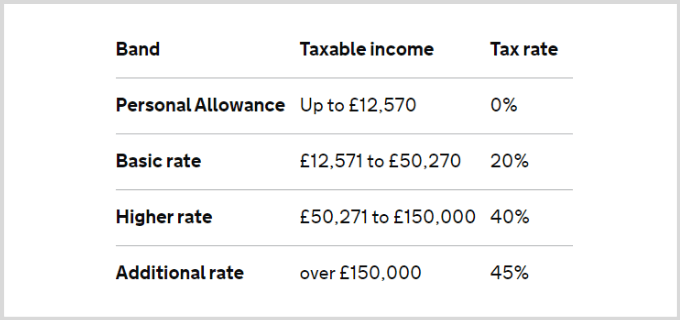

As aforementioned, tax is charged progressively dependent on how much you earn in the period. There are different tax brackets which are charged different tax rates. The first tax bracket is your tax free allowance, where you're allowed to earn up to £12,570 without paying taxes. The following brackets are basic, higher and additional which are taxed at 20%, 40% and 45% respectively. The table below illustrates the brackets clearly.

*Personal allowance drops by £1 for every £2 earned over £100,000 until it reaches £0.

Take the example that an individual earns £200,000 in a tax year, the tax calculation would be as follows.

The first £12,570 is tax free and so is unaffected. They would pay 20% tax on the £37,700 in the basic rate band (£7,540), 40% on the £99,730 in the higher rate band (£39,892) and 45% on the £50k in the additional rate (£22,500). This adds up to a total of £0 + £7,540 + £39,892 + £22,500 = £69,932 paid in tax.

P.S. if you have a second job, you will be given a seperate tax code for this job which will either be BR, D0 or D1 (basic, higher or additional) depending on which tax band it falls in.

Passive Income:

Passive income is any additional income that does not fall under employee income. This must too be reported as it is subject to tax. Passive income is any income that does not require active involvement i.e. not trading time for money or overseeing day-to-day operations.

Examples of passive income are: Rental income & royalties from music and books.

Passive income is reported to HMRC via a self assesment form online or the SA100 form by post.

The way that these incomes are taxed vary and depend mainly on the type of income aswell as how much time is spent on the business. Income from rental properties is taxed differently to income from business or trade activities. Consulting a proffesional is beneficial in understanding your unique tax situation.

Read this article to see how rental income is taxed.

Portfolio Income:

Portfolio income lays in the realm of the investor and include sources such as: investments in stocks, gold & silver, crypto, dividends, interests & asset appreciation.

It is a little difficult to distinguish between passive and portfolio income, the main difference being that passive income requires some initial effort or expenditure but continues to yield payments whilst portfolio income does not come from passive investments and is not generated from regular business activity.

Taxation of this source of income is known as capital gains tax. Factoring for taxes in your strategy is key as it allows you to reap the most out of your investments.

Capital gains tax is only triggered when an asset is sold and has gained in monetary value since purchased, otherwise known as realised profit (if you have not yet sold the asset, it is seen as unrealised profit - profit on paper and is not subject to tax (yet)).

There is a capital gains allowance of up to £12,300 per tax year and thus you only pay tax on gains above this figure.

The amount of tax on your capital gains is dependent on which tax bracket the individual falls under. The rate of capital gains tax on residential property for basic rate tax payers is 18% and 28% for higher rate tax payers. The capital gains tax rate for other types of assets is 10% for basic rate tax payers and 20% for higher rate tax payers. Fees like broker costs can be used to reduce the tax bill.

Corporation Tax

Corporation taxes are taxes paid by limited businesses on the profits in that tax period. The tax rates alter massively dependent on the country the business resides, with certain countries such as the Cayman Islands, Panama and Singapore being viewed as tax havens due to thier very low taxing rates.

In the UK the corporation tax is at a flat rate of 19% on all of the profits for the accounting period. This corporation rate has remained constant since 2016. Before this, the tax rate was dependant on the size of the business' profit. Unlike individuals, businesses do not experience any sort of tax allowances but they can bill expenses and deductions to reduce their contributions. Saying this however, in the upcoming fiscal year of 2023/2024, a marginal relief of £50,000 is being introduced and profits above this will be taxed at an increased rate of 25%.

A CT600 form on the gov.uk website must be filled by a business each tax year to file their tax returns. Corporation tax is only payable by limited companies, sole traders and partnerships are charged income tax and are required to fill a self assessment forms instead.

Even if no tax is due, a "nil to pay" form must still be filed. It is the responsibility of the business owner/director to complete and submit the tax document correctly and in a timely manner or late penalties/fines may be applied.

Write offs and deductions that are acceptable are: claims of allowable expenses incurred as a result of normal business operations such as: costs of meetings, equiptment, employee salaries and industry specific expenses; paying yourself a salary (you'll pay income tax on this so keeping it below the higher rate threshold is advisable.); paying tax early, HMRC repays some of it at an interest of 0.5% for payments made earlier than expected.

National Insurance

National Insurance is a sort of state welfare/social security. Payments of national insurance entitles an individual to certain state benefits. It is mandatory for those 16 years and older to pay national insurance if they either earn more than £190 a week or are self employed and make over £6,725 a year.

All national insurance contributions are accumalated in a fund and pay for state benefits such as state pensions, sick pay, maternity leave or unemployment benefits. If you are employed, national insurance is automatically deducted from your pay by your employer. Self employed workers are required to pay these themselves, usually through their self assesment return.

Inheritance Tax

Passing on some/all of your wealth onto your loved ones is normal case for many (rich and common alike), but oh no, the Govt wants a piece of the pie. Inheritance tax is charged at 40% above a tax free threshold.

If you are married, your estate (property, money and possesions) can be passed onto your spouse tax free. No inheritance tax is due too if either the value of your estate is below the £325,000 threshold or the estate above this threshold is given to a charity or community amatuer sports club. The estate value will still need to be reported even if it is below the threshold. If you are married and your estate is worth less than the threshold, any unused threshold can be added to your partner's threshold when they die, so essentially, their tax free inheritance threshold can be as much as £1 million. Certain reliefs and exemptions can be made to reduce the contribution, such as gifting and business reliefs but these are situational.

Closing Thoughts

Taxes are not inherently bad - the government need to make money to carry out their activities and keep our lives bearable. But we can all agree that they don't use said funds as efficiently as can be and so keeping your contributions to a minimum is optimum.

Should the rich pay more taxes?

Who taxes the tax collector...